Asean property markets are promising, with Cambodia offering the most attractive prospects due to strong demand and limited supply, notably in Phnom Penh.

Aliwassa Pathnadabutr, managing director of property consultant CBRE Thailand, said prime residential property for rent in the Cambodian capital has posted the highest yield among all sectors at eight percent per year. Selling prices remain relatively low, but rents are high.

“Demand for rental in Phnom Penh is driven by expatriates working for multinational companies set up in the city,” she said. “Asking rents are high as those companies are willing to spend on good accommodation for their staff.”

With strong demand and a limited supply of only 5,500 units, the apartment sector has an occupancy rate of between 80 to 90 percent while rent per square meter is 700 to 1,000 baht (about $20 to $28).

Rent for a one-bedroom serviced apartment is around 40,000 to 50,000 baht per month ($1,141 to $1,426), the same rate for a unit in Bangkok.

But the average selling price for a high-end unit is only 110,000 baht per square meter, lower than Bangkok’s 200,000-300,000 baht.

She said the selling price per square meter for a high-end residential unit in Phnom Penh is lower than that in Bangkok due to lower land costs. Construction costs, however, are close to those in Bangkok as most of the construction materials are imported from Thailand.

For the high-end segment, the average selling price is 110,000 to 170,000 baht per square meter. For middle-end condos it is 93,000 baht and 24,000 baht on average for the affordable segment.

The foreign ownership quota in Cambodia’s residential sector is higher than Thailand’s, with up to 70 percent of total units at a project. But foreigners are not allowed to buy ground-floor or basement units. Foreigners are also allowed to set up a company with 100 percent ownership.

However, Thai investors should be cautious if they want to jump on the bandwagon as Phnom Penh’s residential supply will reach 25,000 units in 2018 from only 5,000 units this year, Ms. Aliwassa said.

Investing in a condo for rent in Phnom Penh is attractive for individual investors. The major investment buyers in the city are Taiwanese, Chinese, Singaporean, South Korean and Japanese.

“If Thais want to get in on the act, they should do so now or at the beginning of the boom as there will be a large volume of new supply being completed in the next two years,” added Ms. Aliwassa.

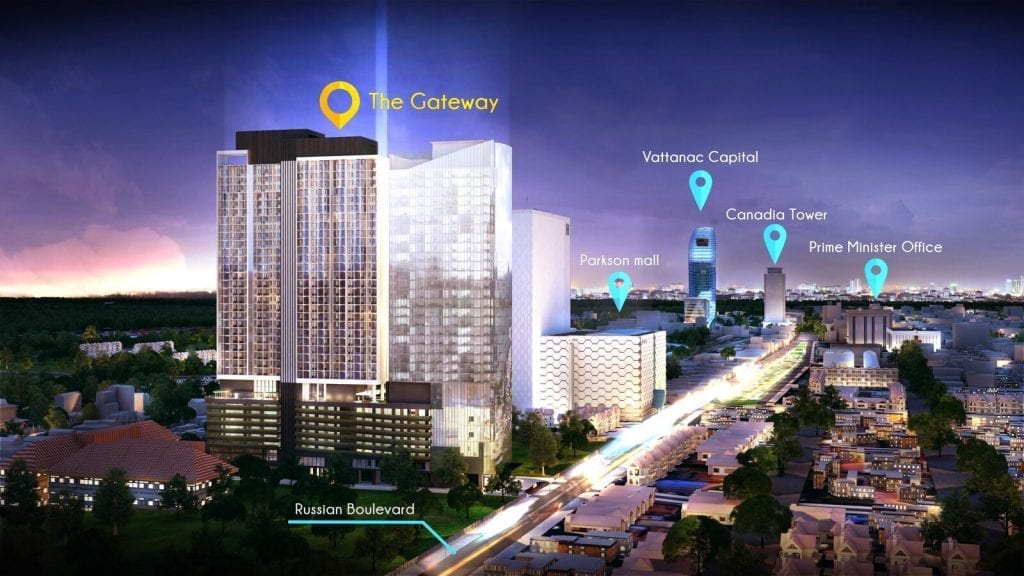

She said office and retail spaces in Phnom Penh are limited but demand is strong so the occupancy rate is quite good. The city’s office supply totals around 280,000 square meters, compared with 8.4 million square meters in Bangkok.

For C-grade office space, occupancy is as high as 90 percent due to a lower monthly rent of $10 to $15 per square meter. Rent for B-grade office space is $16 to $25 with an occupancy rate of 85 percent while A-grade rent stands at $28 with an occupancy rate of only 40 percent, compared with $30 in Bangkok.

Another attractive investment in Phnom Penh is retail, as Thai brands are very popular among Cambodian consumers. Successful Thai retailers in Phnom Penh now include Major Cineplex, Fuji and S&P restaurants.

Nonetheless, the retail property market in Phnom Penh is quite small compared with Bangkok. The current retail space in Phnom Penh totals 680,000 square meters, which accounts for less than 10 percent of Bangkok’s total retail area of seven to eight million square meters.

Despite limited supply, the monthly rent for prime malls remains low at only 1,200 baht per square meter, compared with 3,000 to 4,000 baht in Bangkok.

Although Phnom Penh’s luxury segment has a limited supply, it might be too soon to enter the market as the segment is very small and Cambodian consumers are not ready to accept luxury prices, said the consultant.

“Besides checking local regulations, investors should consider the balance of costs, prices and returns. If one of them is too high, the rest will fall down just like in Myanmar where land costs are very high,” added Ms. Aliwassa.

Tony Picon, managing director of property consultant Colliers International Myanmar, said all commercial properties in Yangon are attractive with high occupancy rates since supply is limited and demand is strong.

“New supply is difficult to enter as regulations are unclear and land costs are steep,” he said. “But opportunities in Myanmar are high as its GDP is the highest in the region at 8.3 percent. The country also boasts abundant resources.”

Suphin Mechuchep, managing director of property consultant JLL Thailand, said Vietnam is an interesting investment destination as its economy is picking up, purchasing power is strong and the government is spending on infrastructure projects.

“All segments in Vietnam’s property market have bottomed out in the past two years as middle-income earners prefer spending on IT, mobile and technology,” she said.