The demand for IMAX China shares has not met expectations, according to a filing on Wednesday.

The $248-million initial public offering (IPO) of IMAX China Holding Inc. in Hong Kong saw a relatively weak demand from retail investors, according to a filing on Wednesday.

The demand for new listings in Asia Pacific stock markets has been hurt by the weakening of the Chinese stock markets earlier this year, as well as the rather sporadic performance of other equity markets around the world.

IMAX China Holding Inc., majority-owned by the giant screen movie theater equipment maker of the same name, is most likely a casualty of this market slowdown.

There have been some signs of improving confidence in the market, with China Huarong Asset Management Co. and China Reinsurance Group interested to make their Hong Kong IPOs this week, worth a combined $5 billion. However, market players and analysts have said that it is still too early to predict a recovery.

“Sentiment has not recovered, it’s not that strong yet because the market remains volatile recently,” according to Jasper Chan, a Corporate Finance Officer at brokerage Phillip Securities in Hong Kong.

The IMAX China IPO was priced last week at HK$31 ($4) per share, near the bottom of its marketed range. Demand for shares from retail investors accounted for a mere 70 percent of the shares that were offered, according to the filing.

In comparison, the listing of Yunnan Water Investment Co. Ltd. in May was demanded by retail investors 354 times the number of shares offered.

In April, the listing of Shanghai Haohai Biological Technology Co. Ltd. was oversubscribed around 180 times the shares offered.

However, the institutional tranche of the deal was oversubscribed, according to IMAX China.

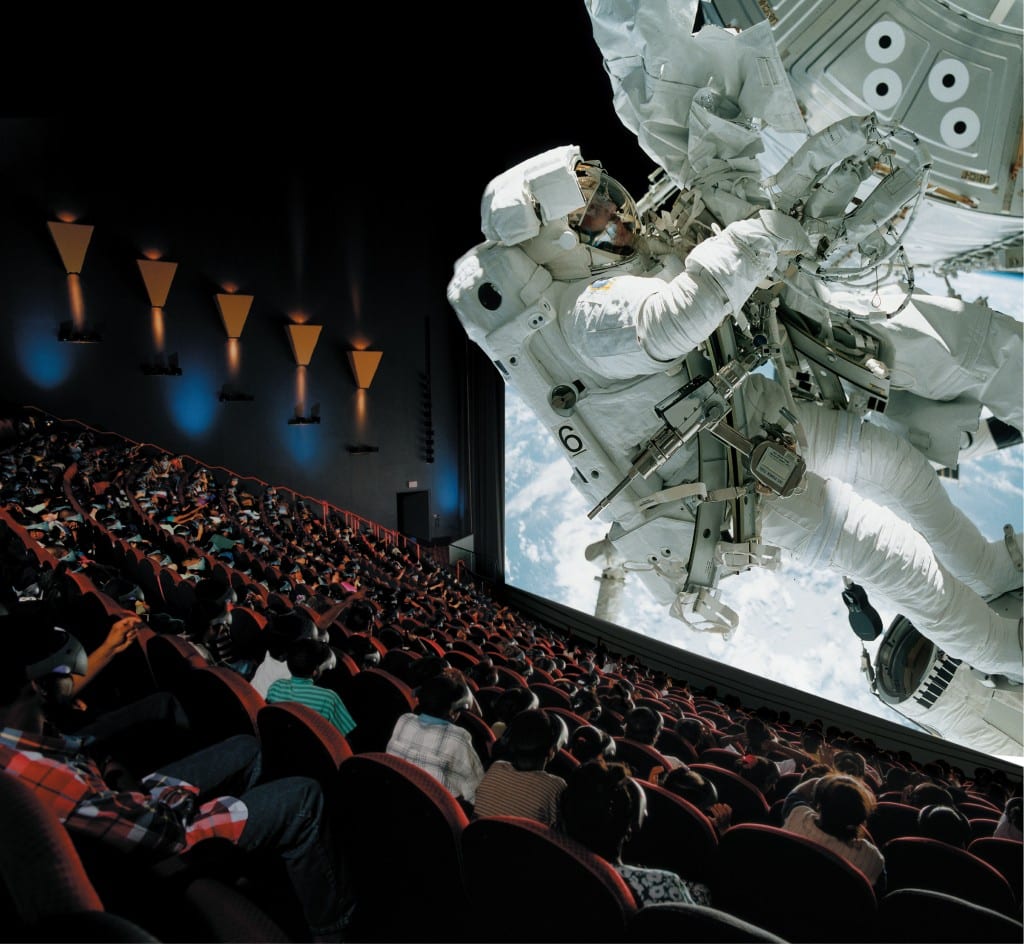

The IMAX Corp. China unit debuted on the Hong Kong stock exchange on Thursday, marking the first listing by a major global brand there since 2011.