WhatWeLike, an Indonesia online fashion social shopping startup has closed a seed funding round of an undisclosed amount from local VC firm East Ventures.

According to the company, the funds will be used to recruit new talent, develop mobile initiatives, and implement more aggressive marketing strategies to accelerate growth.

WhatWeLike is headed by local serial entrepreneur Aswin Tanu Utomo, who is perhaps best-known as the founder of AdaDiskon, a six-year-old online media portal that zeroes in on information for shoppers including deals, local bazaar information, midnight sales in Indonesia, and more. Utomo also started PlusKu, a spa, health and beauty eCommerce site that ultimately closed down in early 2014. He launched WhatWeLike in December the same year.

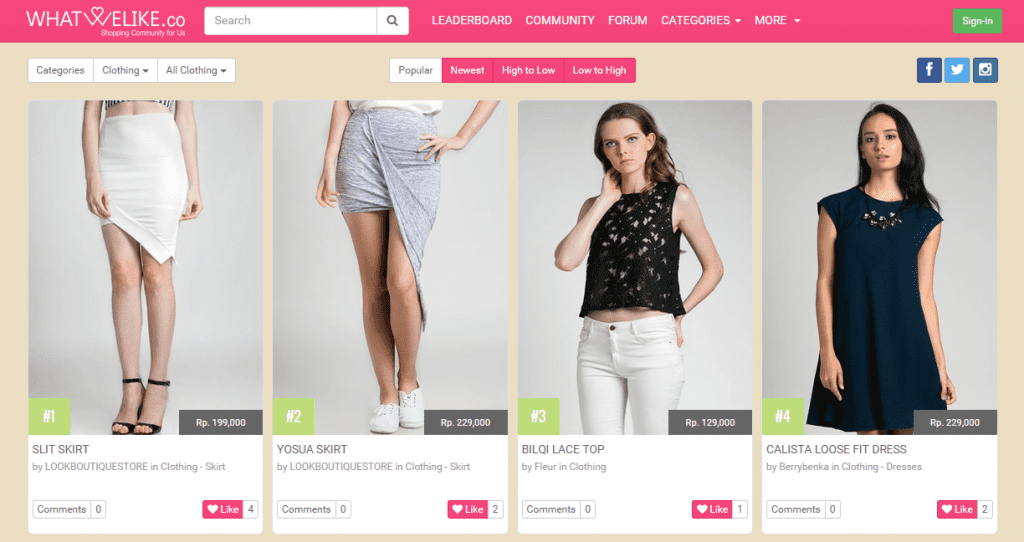

“We want to help users discover the best and hottest fashion products in Indonesia,” says Utomo. “There are literally hundreds of thousands of items available, with hundreds more released each day, which makes it really difficult for shoppers to find out what is currently popular and what is not.”

WhatWeLike uses its own visibility ranking system based on freshness, engagements, and other factors. The ranking algorithm helps shoppers discover which items are currently popular.

“There are an estimated 43 million employed Indonesian women that represent 52 percent of the working-age population of women in the country,” says Willson Cuaca, managing partner of East Ventures. “This is a huge potential market, as Indonesian women are the key influencers in both modern and traditional trade stores.”

Cuaca adds that Indonesian women’s disposable income per capita grew at a compound annual growth rate of 12.5 per cent between 2010 and 2012. It was the fastest in ASEAN, and fashion is one of the top trade categories beside cosmetic and household products in the archipelago.

WhatWeLike’s business model is based on commission generated by providing leads to fashion eCommerce companies. The range of commission varies depending on the client, says Utomo. WhatWeLike aims to create US$2 million to US$3 million per month in revenue for its Indonesian partners over the next two years.

Utomo did not comment on the number of active users WhatWeLike currently has. He did say that WhatWeLike’s “still quite small” traffic has grown 60 to 70 per cent per month since January, with a conversion rate of five to eight per cent without optimisation.

In Indonesia, Utomo says WhatWeLike will be competing with Shopious,Kleora, Oiffel, and Zocko. However, he remains optimistic that there is still room in the market for his firm, a company which he says is addressing problems in different ways than the competitors.

“The potential market is very large for WhatWeLike, not just in Indonesia, but also [across Southeast Asia]. We function as the social and discovery layer above our eCommerce partners,” Utomo adds.