Mobile payments will soon overtake cash and credit cards as the preferred payment choice for Chinese travellers shopping abroad, according to a new survey.

Mobile payments specialist Cancan and financial research authority Kapronasia have published a global study, 2017 Mobile Payment Survey: Chinese Consumers Abroad, covering the impact of Asian mobile payment solutions at point-of-sale worldwide. Over 1,000 Chinese consumers and more than 60 C-level decision-makers from global merchant companies were surveyed.

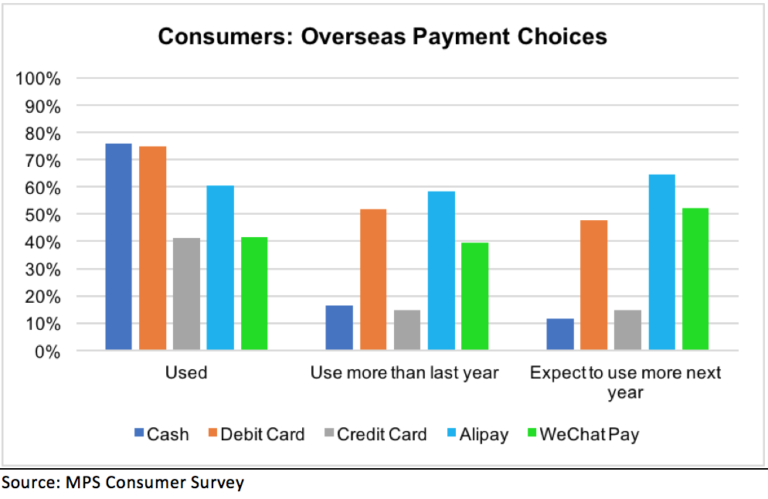

Among the key findings, the study found that Mainland Chinese consumers expect to spend more with mobile payments such as Alipay and WeChat Pay this year and next year than in 2016 when travelling abroad.

Most Chinese travellers spent in the range of either US$393–US$786 or US$1,179–US$1,572 for retail purchases on their most recent overseas trip, the report found, while 5.7% spent more than US$6,288.

Some 67% of respondents reported that they use mobile payments overseas. When consumers were asked about their primary method of payment while overseas, mobile payments represented about 41% of overseas consumption.

Nearly half of the consumers surveyed made between 10-30% of their overseas shopping purchases with QR code-based mobile payment methods; one third of consumers paid over 50% of their purchases in China with mobile.

Fashion and cosmetics/skincare are among the categories consumers were most likely to purchase with mobile payment.

The survey found that transaction convenience and the ability to track purchases in real time were the primary reasons for using mobile payments. Not needing to carry cash and credit cards was also appreciated. “You can easily spend days in China without opening your wallet, and consumers expect that too when they are shopping overseas,” the report said.

The main reasons for not using mobile payments were merchants not offering the facility, as well as consumers’ ignorance that it was possible to use mobile payments when merchants do offer it.

Alipay, WeChat Pay and Apple Pay are the most popular mobile payment methods. Over 75% of the surveyed merchants accepted Alipay. Over one third of merchants who do accept mobile payments indicated that it contributed to at least 3% or more of their global sales, with some experiencing a share as high as 15-25%.

Although customer demand is primarily driving merchant adoption of mobile payment (over 80% of respondents agreed that they were reacting to customer demand), retailers also appreciate the speed of transaction and many desire to be seen to be “ahead of the game”.

Cancan Managing Director Candice Koo: “Global merchants can profit from the mobile payments revolution storming out of the Far East, but they need to focus on the Chinese consumer”.

“If the overseas market continues to mirror China’s mobile payment growth and development, this will likely change over time. Loyalty and points programmes in mainland China were slow to take off but are now informing an increasing number of merchant’s digital strategy, many of whom all have domestic WeChat official platforms.”

Cancan and Kapronasia concluded that as well as there being continued growth in mobile spending, there will also be a change in what consumers buy using mobile payments.

“Although they started out being used for smaller value purchases, mobile payments are increasingly being used for higher value and luxury items,” the report said. “The average transaction value on Alipay went from US$82 in 2015 to nearly US$100 in 2016, an increase of +22%.

“The implications for overseas merchants are pretty clear: mobile payments have become a way of life for many Chinese and Asians and their habits are extending overseas.”