|

|

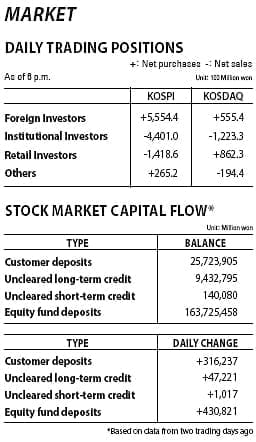

Korean stocks closed slightly lower Friday as institutions and retail investors dumped local stocks offsetting a buying spree by foreign traders. The South Korean won extended its rally against the U.S. dollar.

The benchmark Kospi slipped 0.8 point, or 0.03 percent, to close at 2,533.99. Trade volume was moderate as 355.21 million shares worth 6.46 trillion won ($5.88 billion) changed hands, with gainers barely beating losers 404 to 394.

The index started higher on an upbeat mood after a U.S. tax reform bill made some progress in Congress, but institutions expanded their selling as the strengthening local currency raised the concerns of major exporters.

Oil prices also ended lower again on Thursday on increased concerns about rising U.S. supply despite major producers’ efforts to tighten the market.

|

|

“If the Korean won continues to strengthen against the U.S. dollar, it could burden major exporters in the short term,” Kim Byung-yeon, an analyst at NH Investment & Securities, said.

Offshore traders bought a net 549 billion won worth of local stocks, while institutions and retail investors sold a net 442 billion and 127 billion won, respectively.

Auto shares were down as the rising value of the local currency raised concern over their price competitiveness in overseas markets.

Industry leader Hyundai Motor declined 1.57 percent to 157,000 won, and its auto-parts maker Hyundai Mobis dropped 3.04 percent to 255,000 won.

Tech shares were in positive terrain. Market bellwether Samsung Electronics inched up 0.07 percent to 2,791,000 won, and SK Hynix, the world’s No. 2 chipmaker, edged up 0.61 percent to 83,000 won.

Airlines were among best performing stocks as lower oil prices and the stronger local currency are expected to lower their financial burden and costs.

Korean Air, Korea’s largest airline, jumped 5.48 percent to 32,750 won, and its smaller rival Asiana Airlines shot up 11.26 percent to 4,840 won.

Secondary Kosdaq closed at 775.85, down 4.37 points or 0.56 percent from the previous trading day.

Top-listed Celltrion lost slipped 0.09 percent to close at 218,800 won.

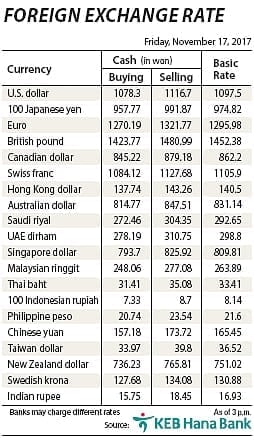

The Korean won closed at 1,097.5 won against the U.S. dollar, up 3.9 won from the previous session’s close, which rose to the highest level since September 2016.

Bond prices, which move inversely to yields, fell. The yield on three-year bonds gained 0.3 basis point to 2.174 percent, and the return on the benchmark five-year government bonds added 0.8 basis point to 2.383 percent.