At this time of year, New York City’s Fifth Avenue is a sparkling sea of holiday lights. There’s Cartier with its illuminated Panther; Harry Winston with its diamond-shaped orbs; and then there’s Tiffany, which seems to have decked its store with lights that Las Vegas discarded in the 1970s. It is a small point, but it is one that underscores the fact that parts of the Tiffany business remain firmly out of step with the modern world of luxury retail.

Yet there is progress: only parts of the group are behind the curve. A year or so ago, the whole organisation appeared to be struggling to keep up, but a raft of initiatives have since helped to pull elements of the proposition into the 21st century.

This work shows up in the latest numbers which continue along an improved trajectory. Total sales are up by a respectable 3 per cent, and while comparable sales remain in decline, it is encouraging to see this is no longer because of weakness in the North American market. On the bottom line, net income rose by 5.4 per cent.

What has Tiffany done to engineer this improvement?

The product has to be the starting point, with the greater emphasis on fashion and designer collections generating interest among younger consumer segments. The urban Tiffany HardWear range has performed particularly well, while Elsa Peretti’s assortment of pieces has added a gentler contemporary edge to the offer.

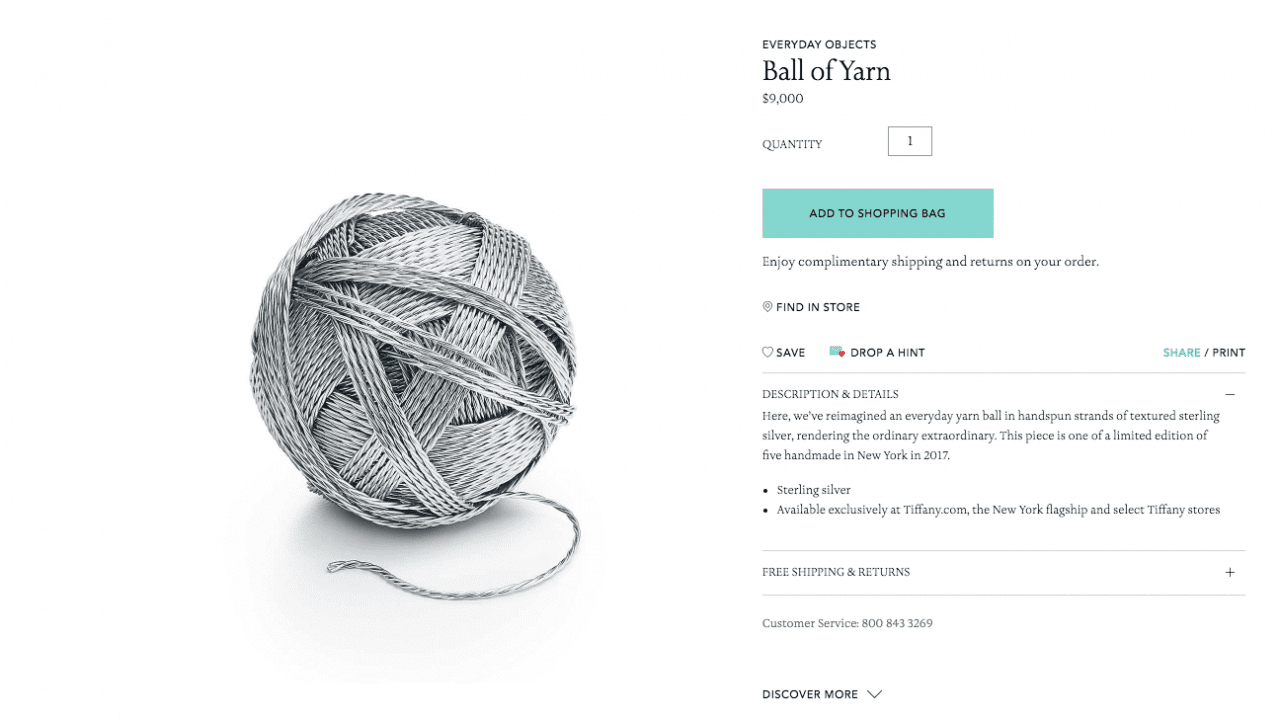

Tiffany has recently followed up this success with the whimsical Everyday Objects collection of decorative accents. It is unlikely that the $9000 sterling silver ball of yarn nor the $1000 silver tin can will be to everyone’s taste or budget, although they generated some favorable publicity for the brand.

Behind these headline items, more accessible pieces like the bone china ‘paper’ cups at $95 are likely to attract more interest. The point is that Tiffany is trying something new and is grabbing the attention of shoppers.

As well as using its products to showcase the brand, Tiffany has also upped its game in general marketing and advertising. These have been more in vogue than past campaigns, and the use of celebrities like Janelle Monáe, Zoë Kravitz, & St. Vincent (Annie Clarke) is helping consumers to see the brand in a new, more modern light.

Moving online

One interesting consequence of this gentle repositioning is that many of the younger shoppers Tiffany is starting to attract are going online rather than into stores. This has resulted in some robust e-commerce numbers. It is to Tiffany’s credit that it has responded by improving the website experience and by increasing the amount of content across its platforms.

This outperformance of online is likely to continue, which presents a dilemma to Tiffany. Many of its stores are in desperate need of refurbishment and ideally, need to be brought up to the same standard as the new Union Square shop in San Francisco. This is an expensive undertaking and one that the group may struggle to justify if more sales are migrating online.

The new Blue Box Cafe in the New York flagship is a smart way of pulling people into the store, but this initiative can’t be easily replicated across the estate. Moreover, it is a shame to draw people into a shop that still feels dated and fusty.

Despite all the progress, further change, especially in stores, is essential. For as much as Tiffany has made strides, it has not yet regained that full youthful vigour that so many of its peers exhibit. The gaudy, old-fashioned lights on its New York store underscore that there is much more thinking, and much more work, to do in the reinvention of this heritage brand.