However, Yum reiterated its fourth-quarter guidance for comparable sales growth of zero to 4 per cent, noting that it remains “difficult to forecast in China”.

“While an early sign of perhaps some stabilisation in the market, investors should avoid being overly buoyed by the magnitude of the beat, as China sales have been extremely volatile, and we were not provided with the year-ago monthly compares,” according to Jason West, an analyst at Credit Suisse.

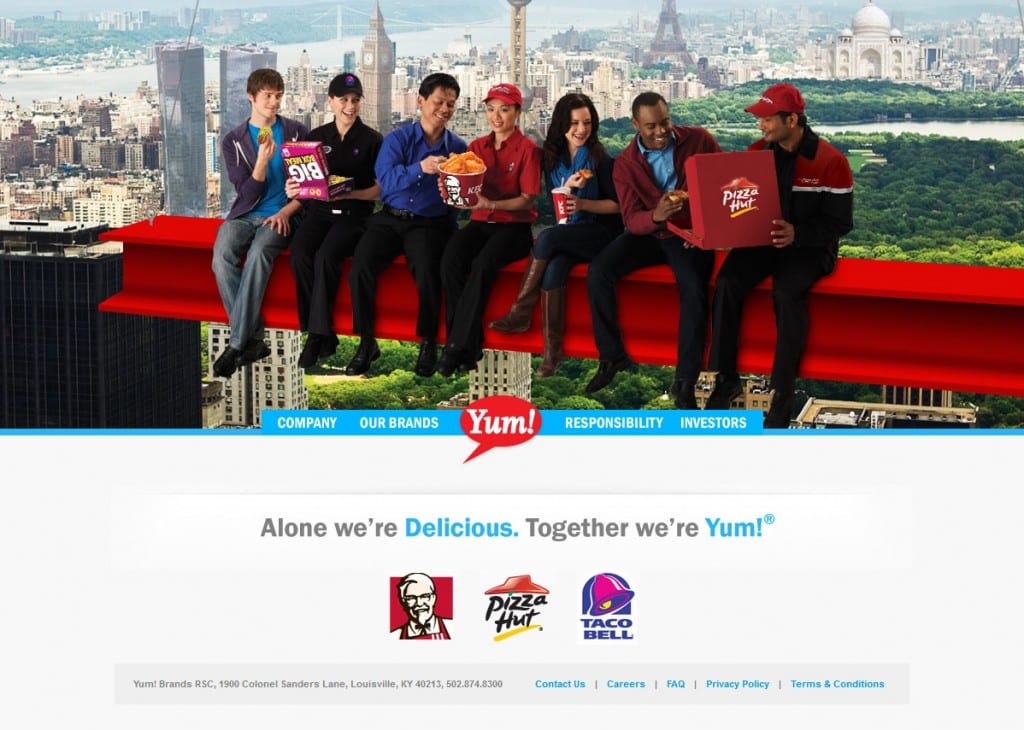

The news comes a month after Yum announced plans to spin off its Chinese operations, which accounted for about half the company’s overall revenue last year, into a separate company.

Shares in Yum gained more than 2 per cent to $68.64, trimming its year-to-date decline to 5.8 per cent.

Retail stocks continued to get punished ahead of the key US shopping season after Nordstrom cut its full-year profit forecast a day after Macy’s.

The S&P 500 department stores index, which includes just Nordstrom, Kohl’s and Macy’s, fell 8 per cent on Friday and is down nearly 17 per cent for the week. The broader S&P 500 retail index declined more than 5 per cent over the week.

Retailers have attributed weak results to warm weather and the strength of the US dollar, which has hurt tourist spending. Analysts said weak customer traffic has resulted in higher inventory and that could drive more promotional activity during the key shopping season

Nordstrom shares tumbled more than 16 per cent to $53.05 after the upmarket retailer said it now sees earnings in the range of $3.40 to $3.50 a share, compared with its previous outlook for $3.70 to $3.80. This missed analysts’ estimates for $3.80.

Meanwhile, the retailer expects to increase same-store sales for the year by 2.5 per cent to 3 per cent, below its previous forecast.

Nordstrom said profits fell nearly 43 per cent to $81m or 42 cents a share, shy of analysts’ estimates for 72 cents a share. Adjusting for one-time items earnings of 57 cents a share also missed. Total revenues rose 6 per cent to $3.3bn.

Despite reporting better than expected results, shares in JC Penney fell nearly 14 per cent to $7.59 amid the broader sell-off in the sector.

Mylan shares jumped 13 per cent to $48.99 after the drugmaker’s attempt to buy rival Perrigo in a $26bn deal failed. Perrigo shares fell 7 per cent to $145.98.

The S&P 500 declined for the third consecutive day led by a sell-off in the consumer discretionary sector.

At midday, the S&P 500 was 0.8 per cent lower to 2,030.37, the Dow Jones Industrial Average had declined 0.9 per cent to 17,295.14. The Nasdaq Composite fell 1 per cent to 4,957.21.