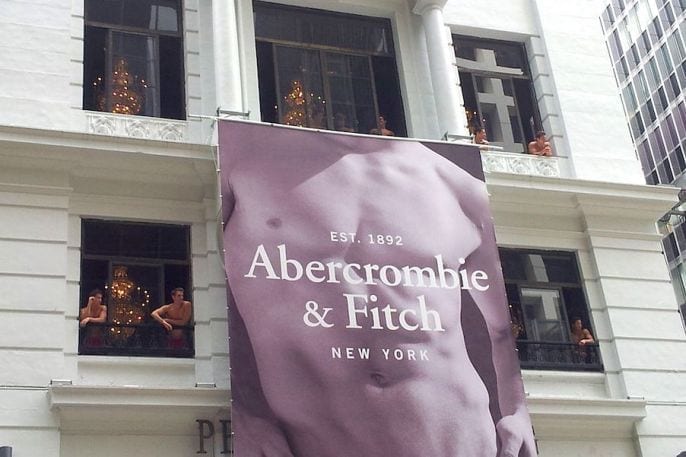

US fashion chain Abercrombie & Fitch will close its four-storey flagship store in Central as early as next year amid the economic downturn and a slump in shoppers from the mainland.

The 25,600 sq ft store on Pedder Street opened in 2011, paying HK$7 million in rent per month, double that of previous tenant Shanghai Tang.

It has initiated an early exit before its lease expires in 2019.

“The company exercised a lease kick-out option for its A&F flagship store in Hong Kong,” the retailer said on Friday. It claimed the move was “part of the company’s ongoing strategic review” and “was expected to drive economic benefit over time”.

The closure of the store should be “substantially complete” by the end of the second quarter of fiscal year 2017.

The move would trigger a “lease termination charge” of approximately US$16 million in the next quarter, it said.

There would be no Abercrombie & Fitch branded store in the city after, but the company intended to add five stores on the mainland by the end of January.

Comparable sales of the brand fell 14 per cent between August and October compared with the same period last year.

It did not reveal its sales performance in Hong Kong.

The city’s retail sales slumped 9.6 per cent in the first nine months of the year.

Helen Mak, senior director and head of retail services at researcher Knight Frank, said Hong Kong was gradually losing its appeal to mainland tourists as a prime shopping destination after 10 years of high retail growth.

Earlier this month, US fast-fashion brand Forever 21 said it would close its flagship store in the heart of the Causeway Bay shopping district late next year.

Helen Mak, senior director and head of retail services at researcher Knight Frank, said many retailers had expanded aggressively a few years ago when the Chinese economy was strong and shoppers poured into the city.

A&F had made aggressive expansions in the city a few years ago when the Chinese economy was still strong and mainland shoppers tourists poured into city to buy luxury goods.

“Many retailers were optimistic about the market outlook at that time … But they may not be able to afford it now,” Mak said.

Tourism spending by Chinese visitors has fuelled the boom in Hong Kong’s retail and commercial property sectors in recent years.

Coach, another premier US brand, also closed its four-storey main store in Central last year amid weak retail sentiment.

“Hong Kong is not too special a place for shopping in Asia. Many mainland shoppers now choose to go to elsewhere in the region, such as Japan, South Korea, Taiwan, etc,” she said.

Last but not least, the yuan depreciation has also hit retail businesses, as a declining yuan makes Hong Kong goods more expensive for mainland shoppers, Mak said.