Famed denim streetwear brand Diesel USA has collapsed, filing for bankruptcy protection in Delaware.

According to papers filed with the court, the company has up to $100 million in assets and as much as $50 million in debts. The company filed for bankruptcy after unsuccessfully lobbying landlords for rent reductions.

However under a three-year proposed restructuring program, Diesel says it does not plan to reduce its store network, rather to find more affordable locations.

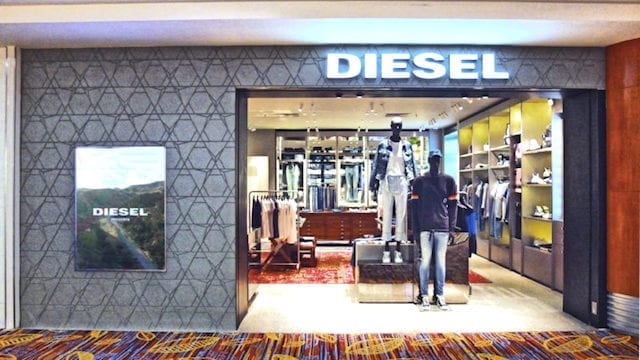

Diesel USA has 28 retail stores across the country and about 380 employees. It also wholesales through department stores and specialty retailers

In the 1990s and early 2000s, Diesel USA, the North American unit of Italian-headquartered Diesel SpA, was at its peak, “dominating pop culture”. As a result it was commanding a high premium for its clothes and could justify seeking high-profile – and thus high-rent – locations in major cities across the US.

Now those leases are no longer affordable and landlords seem reluctant to reduce rents to maintain a tenant no longer at its peak of popularity. The company has managed to get a reduction on only a single store despite a year of negotiations.

Bloomberg reports the company had also been affected by several instances of cyber fraud and theft, costing it about $1.2 million.