GoSwiff, a global leader in digital payments, announced a partnership with UnionPay International (UPI), a global payment network, to enable merchants on Nimmanahaeminda Road in Chiang Mai to accept UnionPay cards. Using GoSwiff’s mobile point of sale (mPOS) solution, micro merchants can now accept and process secure PIN-based card transactions in Thailand.

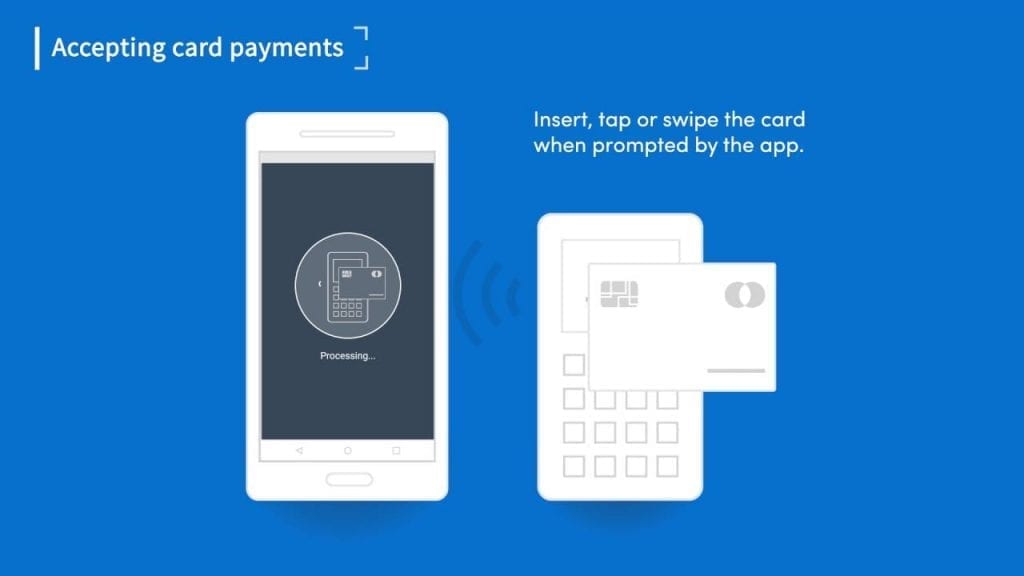

Merchants and shoppers on Nimmanahaeminda Road, a street popular with both locals and tourists visiting Chiang Mai, will reap significant advantages with the launch of mPOS. Merchants will benefit from the convenience of digital payments, while consumers can pay with their UnionPay cards, minimizing foreign exchange costs from ATM withdrawals and reducing the risk of carrying cash. All the banks within the UPI network can now connect to mPOS, and leverage NFC, HCE and PIN payments for the first time in Thailand.

“We see great benefits in this partnership with GoSwiff in the Thai market,” said Wenhui Yang, General Manager, UnionPay International, Southeast Asia. “We are not only enabling small merchants to accept micro-payments securely, but also supporting our customers who prefer to pay with cards. With the help of our contactless mobile payment solution, we are confident this will lead to a wider adoption of cashless payments in Thailand and Southeast Asia alike.”

On Nimmanahaeminda Road, small and mobile merchant stalls are not able yet to provide PIN-based card acceptance through regular electronic data capture platforms. There are constraints on telephone and electricity lines and investment requirements on the bank’s side.

“Thailand has seen an enormous increase in mobile payment acceptance in recent years thanks to the very active approach from the banks to roll out mPOS services to their clients. The Bank of Thailand has encouraged all debit cards to include a PIN code, which will create even more interest from the merchants to use mPOS”, said Svyatoslav Garal, Head of Asia Pacific and CIS, GoSwiff. “We have implemented mobile payment solutions for banks and Mobile Network Operators across the globe and boosted electronic payments in the emerging markets. The payment ecosystem greatly benefits from our mPOS solution with UnionPay, as well as the expansion of payment acceptance locations, especially in countries where the card penetration is increasing.”