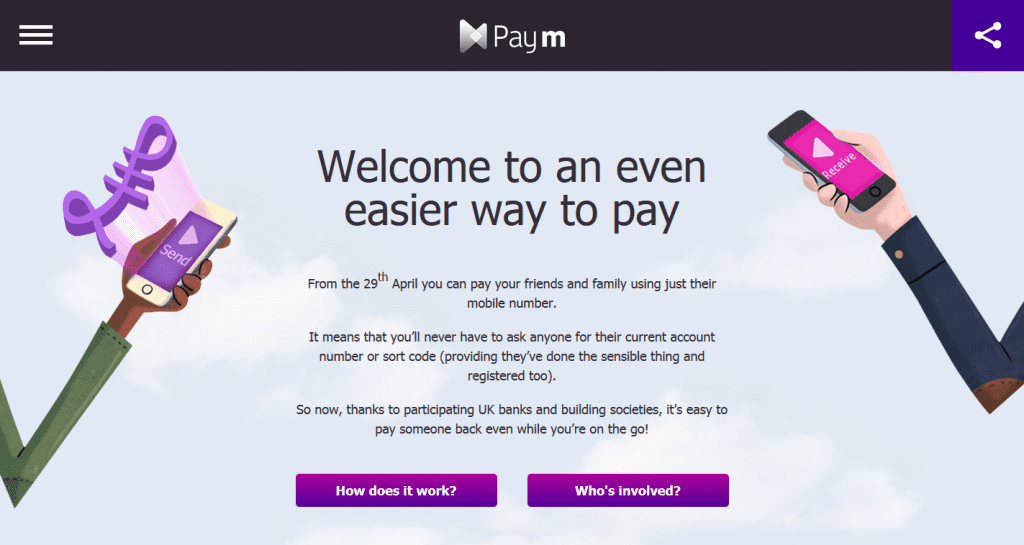

Singapore is looking into the creation of a payments system similar to the UK’s Paym that would let someone send money using only the recipient’s mobile number, email address or social network account.

With this in mind, the country is also working towards a unified POS terminal that can read all kinds of cards at retail and hospitality outlets.

Menon’s remarks came during a discussion on how Singapore can harness the power, and manage the risks, of fintech. The island has been aggressively pushing itself as a major global hub for the fast growing industry – last week it opened a dedicated office designed to help startups set up in the country as a part of a S$225 million, five year plan to build a vibrant ecosystem for innovation.

Menon says that fintech is fundamentally changing the financial industry, and may well be its best hope for the future. He told the audience that MAS’s job as the country’s regulator is to adopt a risk-based approach to fintech innovation, not front-running but running alongside.

The watchdog does this by actively engaging with fintech firms and allowing them to experiment with new technologies in a safe environment. This will be boosted soon by the introduction of a “regulatory sandbox” where firms can experiment and launch products or services within controlled boundaries.

The all-in-one P2P payments platform and unified POS system are also part of MAS’s plan to promote innovation, this time by enabling interoperability. Another aspect of this strategy will see the publication of open APIs, with MAS working with FIs on sharing aggregated data to improve market and risk analyses, forecasts and projections.