Xiaomi relied a lot on online sales in its first years, selling competitively-equipped smartphones at cost. With that strategy, Xiaomi managed to rise to the top of the smartphone charts in China and India within four years of its establishment, becoming the third largest smartphone maker in the world by 2014.

However, the rising giant hit a rough patch at home in 2015, dealing with a crowded, slowing Chinese market. Xiaomi’s smartphone shipments grew by 226 percent in 2014, slowing to just 17.6 percent growth in 2015. Shipment volume declined in 2016 to a rumored 41 million (down from over 70 million in 2015) scaling back global expansion and giving its investors something to worry about.

That setback didn’t last. Xiaomi has since expanded its smartphone shipments to Europe, becoming the fourth largest company behind Samsung, Huawei, and Apple in Central and Eastern Europe in Q2 2017.

But the world outside of China was not enough. As the world’s largest smartphone market, China is strategically important to Xiaomi, but its strategies for early success in this ever-changing region were unsustainable. Today we’ll explore how the combination of platform, offline retail, and marketing expansion has allowed Xiaomi to regain traction back in China and expand globally.

Xiaomi’s China Struggle

Xiaomi’s 2015 stagnation and 2016 shipment decline was due to a number of factors. Slowed growth in the Chinese smartphone market in 2015, for one, contributed to the setback. However, the changing competitive landscape in the region was possibly the unicorn’s biggest challenge.

Competitive Advantage Disappears

Xiaomi maintained a strategy of flash sales and relying on its loyal user base to bypass traditional marketing expenses combined with online sales to forgo the costs of brick and mortar retail stores.

Xiaomi’s business strategy proved to be a strength in its first couple of years, but contributed to its struggle in 2015 and 2016 as the flash sales system has for other e-commerce companies in the past. Furthermore, with online sales its primary means of attracting users, Xiaomi potentially neglected key consumers in lower-tier cities and rural areas of China, where individuals relied more on local retailers because of logistical barriers.

Emerging players like Oppo and Vivo filled the gap left by Xiaomi’s absence in these areas in 2015 and 2016, selling low-end smartphones, but also offering offline retail stores in rural areas. Oppo now has a reported 200,000 brick and mortar retailers in rural China.

Furthermore, unlike Xiaomi, with an offline approach to sales and no online fanbase, Vivo and Oppo relied on aggressive advertising and retail subsidies to market their products and gain users. This strategy worked well for the two companies. Oppo became the leading smartphone supplier in China in 2016, with a year over year growth in shipments of 122.2 percent.

After Xiaomi’s slowed growth in 2015, the company had to prove its viability to investors, especially with a $45 billion valuation riding on its back. It declined to release its sales numbers in 2016, with CEO Lei Jun admitting that the company “grew too fast and drew on some long-term growth.” Xiaomi refocused on switching strategies, playing off of its branding as a company for the Internet of Things (IoT), responding to retail challenges, and refocusing its marketing techniques.

Xiaomi Responds With Investments, Brick And Mortar, And Celebrities

As he stated stated in the early days of the company, Lei Jun always claimed to imagine Xiaomi as less of a smartphone provider and more of a smart home device innovator. Xiaomi started selling TVs back in 2014, adding to the list of non-smartphone items that it had already offered, including portable batteries, set-top boxes, and fitness trackers. The company also developed online media and gaming content.

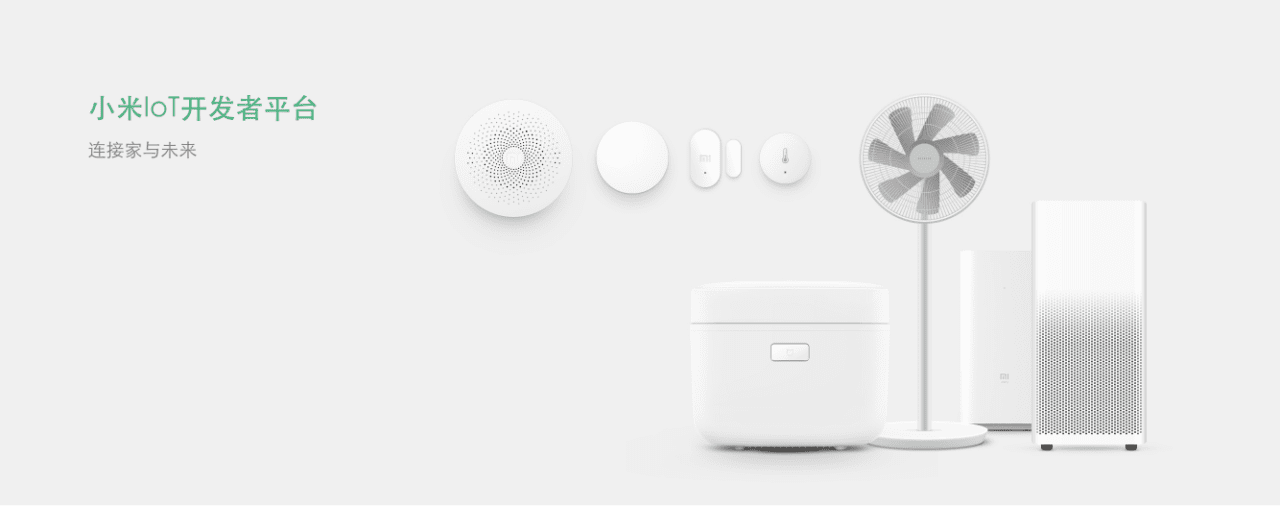

With players like Oppo, Vivo, Huawei, and Lenovo taking note of the company’s low-end smartphone approach, Xiaomi aimed to do more to brand itself as a tech company for the Internet of Things.

In 2016, it launched a mobile payment service, an electric bicycle, a thin MacBook Air-like computer (the creatively-named Mi Notebook Air), a drone, a smartphone-connected rice cooker, a new, thinner MiTV, and an electric ukulele. Xiaomi’s Mainland China website is filled with connected devices, including everything from smartphone-controlled water purifiers and vacuum cleaners to story-telling kids toys and GoPro-like cameras—all connected through the Xiaomi Mi Home app exclusively on its smartphones.

Xiaomi managed to build out its smart home platform by investing in hardware-focused startups and “giving them access to its designers, marketers, and massive supply chain in exchange for a 10- to 20-percent stake and the right to brand and sell those products.” This outsourcing strategy allowed the company to develop its smart home ecosystem. Further, the company maintained its goal of selling its flagship, increasingly innovative smartphones at lower prices than its competitors, as its earnings are driven by its other devices.

Offering the lowest priced smartphone was key to smartphone shipment growth, but by linking its smart ecosystem exclusively through its smartphones, Xiaomi could drive growth even more. However, if the company wanted to compete with Oppo and Vivo, it could no longer neglect those retail customers outside of the urban landscape. The second part of Xiaomi’s comeback involved a huge platform shift.

Brick And Mortar Expansion

“Xiaomi has great ambitions, and we are not satisfied with just being an e-commerce smartphone brand,” Jun told Techcrunch in 2017. “So we have to upgrade our retail model, and incorporate offline retail for a new retail strategy.”

The company that was built upon a platform that eschewed brick and mortar retail decided to bring its sales offline.

Following through with this plan, by the end of 2016 Xiaomi opened more than 50 Mi Home stores in Mainland China. In 2017 it expanded that effort, opening stores in major metropolitan areas, like Beijing, with plans to launch 1,000 stores in China, and 2,000 stores globally by 2019.

Xiaomi differentiated its brick and mortar effort from that of Oppo, Vivo, Lenovo and Huawei by essentially combining Apple’s physical retail setup with product variety. It packed its stores with its smartphones and new smart home devices to entice customers to return to the store frequently and spend more time and money buying its products.

The People’s Smartphone

Xiaomi met its new retail and platform expansion projects with a reinvigorated marketing approach– a marked shift from relying on its online fanbase. An IDC analyst said that the company is directing more of its funds to marketing and advertising. In 2016, more billboards and ads popped up in public areas calling its Redmi line of smartphones the “People’s Smartphone.” In July 2017, the company unveiled its new dual-camera flagship the Mi 5X along with a flashy endorsement by Chinese musical sensation, Kris Wu.

With its shifted strategy, Xiaomi began to regain some ground in the Chinese market in 2017.

Looking at quarterly data in the Chinese smartphone industry, Canalys analyst Hattie He told Crunchbase News that the company led in the under $200 market in China in Q3 2017 with 22 percent of the market share in the segment. In Q4 it ranked second in that category by a small margin, with Huawei taking 25 percent and Xiaomi 24 percent, followed by Vivo and Oppo at 12 and 8 percent, respectively.

Even so, Apple overtook Xiaomi in 2017 for fourth place in China. With a decline in smartphone sales in the region in 2017, competition is only going to heat up in the industry. Companies that heavily rely on their home market for cashflow will likely face significant difficulties in 2018, with Lenovo and ZTE refocusing on the Chinese market.

Hattie expects Xiaomi to stick to its current strategy.

“Xiaomi will keep paying attention to in-house hardware investments, including smartphones and IoT devices… [It] will partner with other well-known hardware and software companies to go into different sectors and provide customized experiences for [the Chinese] market,” Hattie explained.

She also expects the company to continue its online-offline approach by establishing more MiHome stores in sub-tier cities in 2018 to reach a broad consumer base and build a reliable brand image.

Xiaomi’s Global Expansion

In 2017, Xiaomi’s rebound was mirrored in its efforts and successes abroad. After scaling back its global efforts in 2016, the company has since expanded again to markets in South East Asia and elsewhere, taking a top five spot in Central and Eastern Europe in 2017. It increased its offline activity and partnered with local smart device companies in India in 2017, and overtook Samsung as the lead player in the region that year.

Of course, even with these global wins, the company has a long way to go to compete with Apple in the West. It launched an online store for the U.S. and has been selling its globally successful fitness wearable and battery packs in the U.S. since 2015. It started selling set-top boxes in Walmarts beginning in 2016, and in November 2017 released a few of its products on Amazon.

However, expanding smartphone sales to the U.S. is something the company has considered carefully. If Xiaomi entered the U.S., it would compete with Apple and Google in their home markets, but that isn’t its biggest problem. Xiaomi’s past experiences with the companies regarding intellectual property and design theft mean that the company will have to come into the market patented up and prepared for legal backlash– something Xiaomi has dealt with before. When it entered India in 2014, its sales were initially halted when it was slapped with an IP lawsuit. Coming from China, where regulations surrounding IP are significantly more lax, to the U.S. will be quite a shift.

Beyond IP, the company will also have to face the mounting security concerns surrounding Chinese tech companies which have intensified over the past few months. As we reported, a move to the U.S. didn’t work out for Xiaomi competitor Huawei, who was abandoned by AT&T before CES 2018. Xiaomi has made efforts in the past to overcome the narrative surrounding Chinese companies by placing the data of global users in data centers outside of China. However, with the U.S. government increasingly concerned about cybersecurity, it isn’t likely that carriers will be willing to partner with Chinese companies in the near future.

Despite these challenges, Xiaomi may prove to be the dark horse in a global competition with Apple, Google, and Samsung, as it continues to dominate in markets like India where highly-priced devices aren’t the consumer’s choice. Focusing on becoming the “People’s Smarthome” of emerging communities around the world may very well be its winning