Esprit plans to axe 40 per cent of its non-store workforce as part of a radical restructure repositioning the brand for future growth. The embattled Hong Kong-listed fashion retailer is set to incur up to US$217 million in one-off charges as it shutters stores, revamps its stock range and embarks on a new marketing campaign, with a heavy accent on social media.

The bold Esprit revamp plans were laid out in an investor presentation which revealed a new positioning statement for the company. It has trademarked the phrase “radical positivity” but describes it as “a mindset, not a slogan”.

Senior management has led by example, the executive team already culled from 13 to just six, although the company is recruiting two more: a chief product officer and a CEO for Europe and the Americas.

Those remaining executives, including Group CEO Anders Kristiansen, executive chairman Raymond Or, head of marketing Simon Heckscher and CEO for Asia Jan Olsen told investors that Esprit plans to eliminate overlapping functions and reduce hierarchy to become more lean and efficient and allow faster decision making. It will merge five offices at headquarters into one and reduce the size of the office in Hong Kong.

The Esprit revamp will come at a cost with breakeven expected only in two to three years. But the result of running a leaner and more customer-focused business will drive profitable top-line growth in three to five years. The company is targeting an EBIT margin of between 5 per cent and 7 per cent, starting year five.

In the current year, Esprit forecasts a further decline in sales in the “low double digits” resulting from store closures and a continuing decline in customer traffic. It forecasts a one-off bill of HK$1.5 to 1.7 billion in one-off restructuring costs.

Next year it anticipates a return to revenue growth. “We have a clear plan with bold changes. We will return to sustainable growth and profitability,” the management team said.

Store closures

The current store portfolio is being reviewed to evaluate which will be closed, in a phased approach which has already begun and will continue into next year. The company has already shuttered 18 stores in Asia and another 28 in Europe have been closed, downsized or had their rents renegotiated.

From mid-next year the company will start opening new outlets, targeting 220 in China by 2023 and another 78 stores in other Asian markets.

The company wants to reduce personnel costs from 20 per cent of store operating expenses now to between 12 and 14 per cent, and occupancy costs from 37 per cent to between 25 and 27 per cent.

Online, the company wants to reduce its dependency on Tmall by opening on other marketplaces around Asia and revamping its own e-commerce site.

Elsewhere in Asia, the company wants to focus on India (where it opened its first brick and mortar store on November 16), Thailand and the Philippines.

It also plans to revamp its wholesaling business with a new ‘best-in-class’ business model in place by next September.

New model for the future

Esprit says it is building “a new model for the future” – a powerful organisation with a restructured cost base and the executive team has delivered a detailed outline of how it will reconnect with customers.

They were honest about the current state of the business: “Esprit has changed – maybe too much. Our brand identity is inconsistent and we don’t know what we stand for. We’ve lost touch with our audience due to lack of customer focus. Our product, quality and fitting must be improved. Bold changes are needed to return to sustainable growth and profitability.”

But they said there are positive sides to the story: according to a Brand Health Tracker survey in July, Esprit enjoys 87 per cent brand awareness in Germany, one of its core markets, and it is the third favourite fashion retailer there.

And they say the brand knows what it stands for. “We are not fast fashion and we are not a discounter.

We are a brand with a purpose. We will know our consumers by heart, provide clear brand value and strong product proposition and shape a consistent end-to-end consumer experience. We stand for radical positivity, loving our customer and quality, always. This is about more than branding. This is about changing our entire mindset. This is about who we are. .. what we do … how we do it.

“There will always be a customer base that wants well-designed, good-quality and affordable clothes, that last beyond one season.”

The Esprit shopping experience

The company plans to change the Esprit shopping experience online, on app and in store. The online store will be updated and enriched with storytelling and live streaming. It will improve packaging and by the end of this year, promises 90 per cent of EU online orders will be shipped using services which are carbon neutral or commit to reduced emission programs.

A new store concept launched in August features improved customer service, visual merchandising that elevates the product, and “music that lifts the spirit”. Merchandising will be simple, surprising, fresh and playful and storytelling will employed with signage such as “These jeans will change your life. You won’t have to change.”

Esprit also plans a heavy focus on Instagram where it currently has 313,000 followers. Social branding will increase featuring real-time content and happenings in the world. The target is to grow followers to 1 million within 18 months.

Range revamp

Meanwhile, the company has already started revamping its range, addressing fabric quality, fit and the balance of products.

It will reduce the number of SKUs, reduce so-called ‘kick colours’ and strengthen neutrals.

“We looked at sell-through rates and consumer data per colour. Our market survey shows our competitors offer 30-40 per cent black, while Esprit has 15 per cent,” the team explained. So Esprit will strengthen its offer of neutrals like black, white, grey and beige.

From June next year the number of stock options will be reduced by between 20 and 30 per cent. The company believes having too many items leads to higher development costs and complex stock management, which dilutes the brand message.

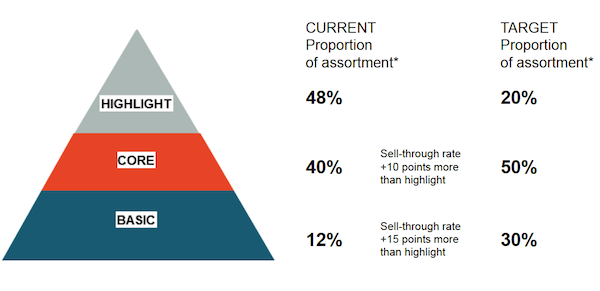

It will change the balance of basic, core and highlight lines from a dominance of highlight to a more even disbursement, as shown below.

Esprit management has identified the rise of quality basic brands, body diversity, athleisure, casualisation and conspicuous consumption as among trends shaping the fashion industry and driving consumer preferences. In response, it plans to offer a more commercial assortment of clothing, improve the quality and fit, develop signature product classes and establish “a unique Esprit handwriting”.

Quality will be enhanced through innovation, functionality, collaboration – such as a winter range featuring 3M insulation – and by looking for opportunities for storytelling online and in stores. The company believes this will boost the sell-through rate to 75 per cent at full price. It will use sustainable denim made from organic cotton and recycled, fibres.

Pants, t-shirts and sweaters comprise more than 50 per cent of Esprit’s current range and those are the staples it wants to be known for in the future.

At the heart of the “handwriting” Esprit refers to is a hub of internal designers which has been created to establish guidelines and directions. It will use information gathered from market trends, competitors and data from its Esprit Friends client base to shape future designs and collections. That work is already starting and will influence collections set for release in fall next year.

China potential

With plans for more than 220 new stores in China over the next five years, Esprit is mindful of first addressing shortcomings in that market.

It admits Chinese consumers perceive Esprit as in line with lower-positioned brands and that they find stores tired and uninteresting. It acknowledges it is missing “basic retail operational focus” in China, has a complicated business structure there with too many layers and its sales associate incentive schemes are not aligned with normal market practice.

Esprit says to recover ground in China it needs to refine the fit of its clothes for Asians, improve quality, adjust deliveries to seasons, improve colour proportions and reduce product options to suit store sizes.

In future, about 70 per cent of the brand’s mainline international collection will be adapted for Asia with amended fitting and 30 per cent will be designed specifically for Asia.

The company plans to launch a two-phase strategic marketing approach starting in January. First, discounting will be reduced, but a “deal feel” will remain in stores and staff will be incentivised to push full-price sales. In phase 2, starting September, markdowns will be restricted, targeted discounts will be offered via email and WeChat notifications, and a new marketing campaign launched to attract new customers.