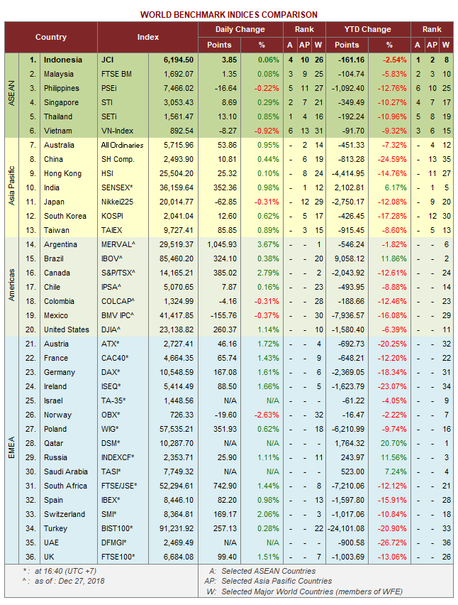

Indonesia’s benchmark stock index declined 2.54 percent overall in 2018 amid a rough year for equities globally. Foreign investors sold a net Rp 50.75 trillion ($3.52 billion) in Indonesian stocks for the whole of 2018, compared with Rp 39.6 trillion in 2017. The market capitalization of Indonesia’s stock market meanwhile stood at Rp 7,023 trillion, compared with Rp 7,052 trillion a year earlier.

The last trading day of 2018 on Friday last week saw the Jakarta Composite Index (JCI) closing 0.06 percent higher at 6,194.5.

Inarno Djajadi, the new chief of the Indonesia Stock Exchange (IDX), said during Friday’s closing ceremony in South Jakarta, attended by President Joko “Jokowi” Widodo, that 57 companies listed their shares in 2018. This is a record high.

Wimboh Santoso, chairman of the Financial Services Authority (OJK), expressed optimism during the event that the JCI would hit a level of between 6,500 and 7,000 next year.

“We are still upbeat that the JCI has a chance to gain further. The OJK will provide stimulus to encourage more companies to list by offering various instruments,” he said.

Wimboh said despite negative sentiment from external factors, such as the ongoing trade war between the United States and China, the business community remains optimistic about the Indonesian economy.

Not Too Bad?

President Jokowi also expressed optimism that the JCI may perform better next year. Citing IDX data, he said despite the 2.54 percent decline, the JCI was the second-best performer in Asia after India, which saw its benchmark stock index gain 6.17 percent this year overall.

Jokowi said 2018 was not an easy year for the country’s economy, which was impacted by both external and internal factors.

He said Indonesia’s large current-account deficit put pressure on the rupiah, which ultimately also affected the financial performance of listed companies. Meanwhile, normalization of US monetary policy, which caused capital outflows from emerging markets such as Indonesia, the US-China trade war and weak commodity prices also impacted Indonesian companies.

“All of these have caused volatility in the JCI’s performance and dragged down the performance of listed companies,” he said.

Jokowi said the government was fully committed to strengthening Indonesia’s stock market, as it should not only serve investors’ interests, but also function as a source of long-term funding for local companies to expand their business and help boost the country’s economy.

According to Inarno, the number of registered investors on the IDX increased by roughly 222,000 to about 851,000, with 29 percent of them actively trading every day.

The average daily trade for the whole year stood at Rp 8.5 trillion with an average frequency of 386,968. This is the biggest in Asia.

Fundraising Down

Fakhri Hilmi, deputy commissioner for capital market supervision at the OJK, said fundraising by Indonesian companies from capital markets in 2018 is estimated at Rp 163 trillion, which is 35.9 percent lower than last year.This figure includes initial public offerings, rights issuances and bond sales.

“This year’s isn’t as much as last year; the value of IPOs were smaller,” he said.

More Stocks Booking Losses

More stocks booked losses in 2018 compared with last year. Of the 619 companies listed on the local bourse, 252 saw gains in their stock prices, while 327 booked losses. The remainder were stagnant.Of the shares that increased in value, 41 booked gains of more than 100 percent, while four increased by more than 1,000 percent.

They are Super Energy, a company engaged in oil, gas and mining and petroleum transportation services, which saw its stock price rise by 1,450 percent this year, and financial services provider Pool Advista Finance, which saw its stock price jump 1,529 percent.

The stock price of Prima Cakrawala Abadi, an exporter of fishing products, jumped 2,006 percent and Transcoal Pacific, a sea transportation and logistics service provider, saw its stock price skyrocket by a massive 3,714 percent.

However, these are penny stocks. Indonesia’s shallow capital markets allow traders and brokers to trick the price of stocks that have low market values.

Meanwhile, only 11 companies of Indonesia’s top 45 listed companies by market value, known as LQ45, booked gains in 2018.