It is always tricky for multinationals to pick a name that sounds right to Chinese ears, but few went as wrong as McDonald’s latest business tweak.

When the news broke last week that the American fast-food giant had changed its business name in China, ditching the previous Maidanglao – a transliteration of the company’s English name – in favour of Jingongmen, which roughly translates as “Golden Arches,” Chinese social media gorged itself with amusement.

“[The new name] sounds like a furniture store. Are you sure the food is edible?” one wrote, while another observed “even Ronald McDonald cannot stand the new name”, referring to a widely circulated image of the clown mascot on the phone, saying: “Boss, I have to quit. The new name is unbearable.”

McDonald’s responded online, reassuring its customers that no one would dine at restaurants carrying the Jingongmen label and the change was for official paperwork only. It is unclear whether McDonald’s will manage to shake off this PR disaster, but even if it does, there are worries the American food giant cannot escape the fate of being downgraded.

“McDonald’s and KFC do not command the brand power they used to in the 1990s,” Jeffrey Towson, a business professor at Peking University in Beijing, said. “They are not viewed as upscale as they were in the 2000s.”

Once a tourism destination in China and a symbol of rapid modernisation, McDonald’s is now known as a low-end, cheap eat for many Chinese. Experts say this colossal change in attitude mirrors the rise of China, where local businesses have become increasingly competitive and Chinese customers no longer have to rely on Ronald McDonald to get a taste of America.

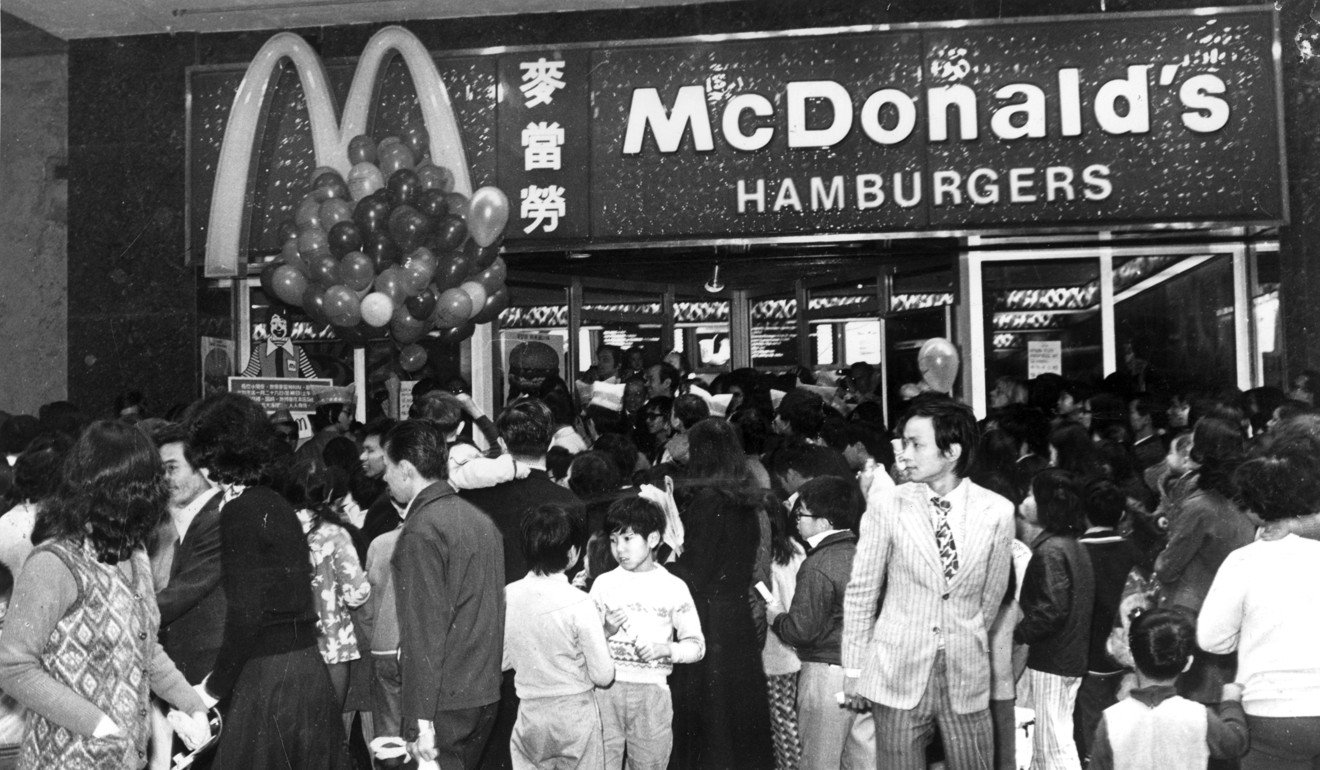

Back in 1975, when McDonald’s opened its first store in Hong Kong, the popularity of McProducts in the then British colony created a phenomenon one local newspaper described as “Big Mac” fever. The fervour spread to Shenzhen, where McDonald’s made its debut in 1990. Media reports showed hundreds of Chinese queuing up outside McDonald’s first store on mainland China, and in the first three hours of its opening day, a week’s supply of products had sold out.

According to Yan Yunxiang, a professor at the University of California who studied the company’s operations in China in the 1990s, McDonald’s was so popular some parents thought the Big Mac contained a hidden ingredient luring their children to this exotic food.

And it was not just the children who had an appetite for it. When the first McDonald’s outlet arrived in Beijing in 1992, 82-year-old Wang Yonglu was one of the first customers. Munching on a hamburger, Wang explained to the United Press International: “I am just a retired proletarian. What chance do I have to go to the United States? This way, I can spend only 10 yuan (US$1.75) to see what America is like.”

Fast forward to the 21st century, the landscape in China is somewhat different. In 2016 alone, roughly 122 million Chinese – equivalent to the population of France, Spain and Denmark combined – went abroad, according to Beijing-based think tank China Tourism Academy.

“McDonald’s has lost that position because Chinese consumers are getting more sophisticated,” Shaun Rein, managing director for Shanghai market consultancy CMR China, said. “If they want Western culture and Western food, they can go to America.”

Zhang Yue, a 34-year-old marketing specialist in Chongqing, knows this well. When McDonald’s entered her hometown in southwestern China in the early 2000s, Zhang happily stood in line as she loved its “spotless dining environment.”

But now, she rarely goes. “There are so many good restaurants out there.”

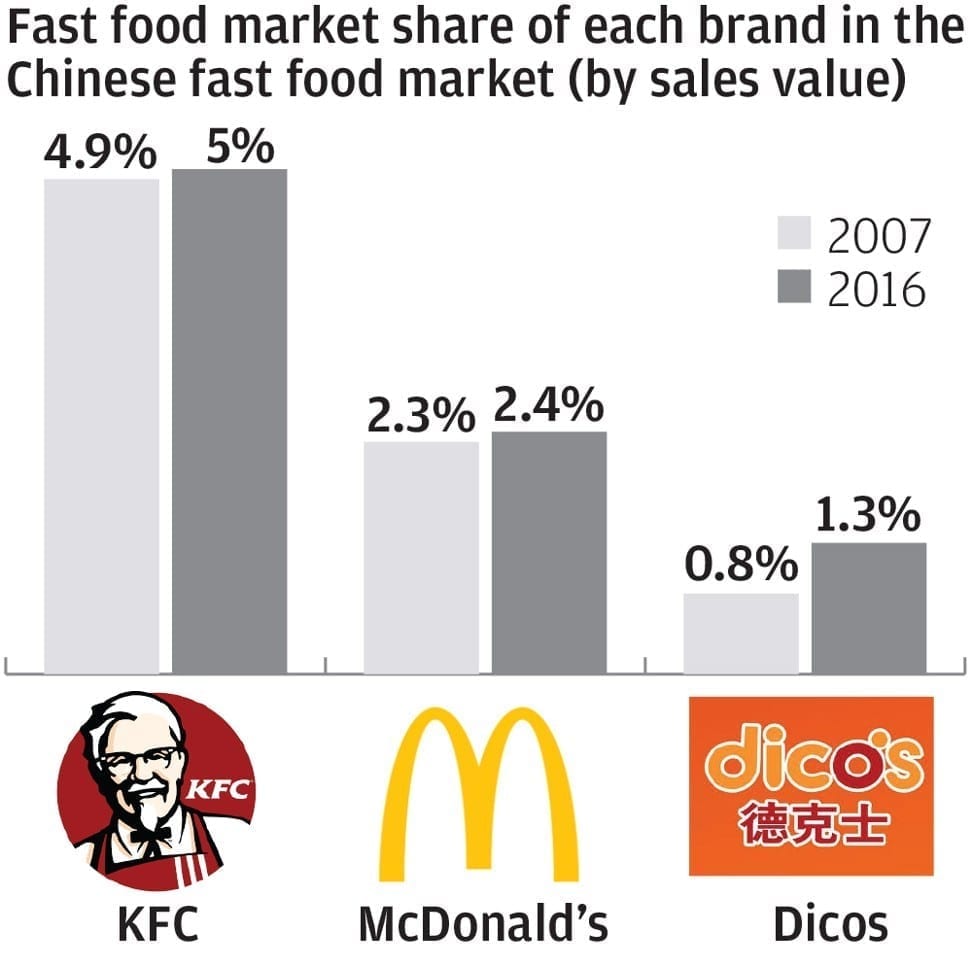

In recent years, a growing number of Western brands have flocked to China, hoping for a bite of the world’s biggest consumer market. Starbucks has opened 2,600 stores, and plans to add a coffee shop a day for the next five years. Meanwhile, home-grown food firms are catching up. Dicos, China’s third-largest fast food chain by retail value, has almost as many outlets as McDonald’s.

The boom of delivery businesses has made getting fed as simple as tapping a smartphone. Last year, at least 7.5 million hungry mouths a day were sated this way, according to a government report. That, in turn, has hampered the business for chains such as McDonald’s.

To lure in more diners, McDonald’s China has localised its menu. Nearly a quarter of its breakfast menu is Chinese food, including congee and soy milk. Earlier this year, the American food chain also sold most of its business in China and Hong Kong to a Chinese consortium for more than US$2 billion. With the help of its new partner, McDonald’s said it will increase the number of Chinese outlets from 2,500 to 4,500 by 2022, with most of the new stores in smaller cities.

“When I studied McDonald’s in the early 1990s, I was told by management the strategy was to stick to the original American menu, not to apply McDonald’s franchise model in Beijing, and not to offer breakfast,” recalled Yan, the university professor. “It looks like the company has done everything now that it said it would not do in the early 1990s … either proactively to go [to] the next level or reactively to meet new challenges.”

The name tweak came after McDonald’s completed its China sale. A spokeswoman said it hasn’t affected the business in China and the company is happy Chinese diners no longer view it as an upscale brand. “After all, we never meant to be a five-star restaurant; McDonald’s is created to serve everyone,” she said.

China’s propaganda authority also had its say. The Beijing-based Guangming Daily, a newspaper backed by the Publicity Department of the Chinese Communist Party, wrote in a commentary last week: “Foreign brands have become ‘rustic’ [as] we Chinese have become more international.”